Takeaways

- 2025 tariffs on plumbing and HVAC imports—especially from Asia—have caused price hikes of 15–35% across essential materials and finished goods.

- U.S. manufacturers and contractors face shrinking margins, sourcing disruptions, and unpredictable project timelines due to global supply chain instability.

- Long-term industry adaptation may include reshoring, diversified sourcing, and greater transparency with customers to maintain trust and service continuity.

A Ticking Pressure Valve in U.S. Plumbing Supply

At North Fort Myers Plumbing Inc., we feel the pressure of 2025’s shifting trade policies every day. With new tariffs hitting critical plumbing materials, prices are climbing fast across the board. Distributors, contractors, and homeowners are all seeing the ripple effects. From tubing to valves, the costs are up and choices are shrinking. This report explores what these tariffs really mean and how they’re reshaping our industry.

Understanding the Scope of the 2025 Tariffs

What the New Tariffs Actually Cover

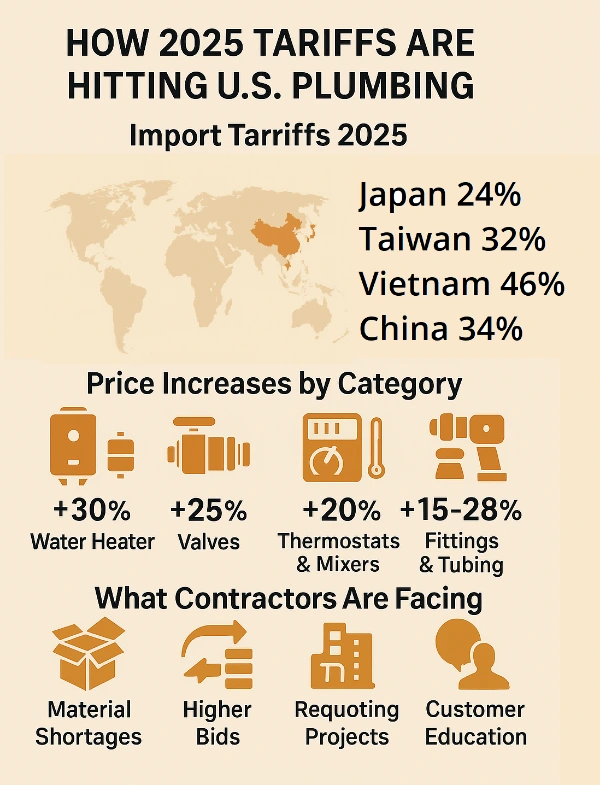

The 2025 tariffs target plumbing and HVAC products imported from major manufacturing hubs. Tariffs now hit equipment and components from countries like China, Vietnam, Taiwan, and Japan. These include water heaters, pumps, copper fittings, and even brass valves. For example, HVAC and water-heating gear from Vietnam now carries a 46% tariff. China follows closely at 34%, with Taiwan and Japan facing 32% and 24% respectively.

The chart below highlights how 2025 tariffs vary by country and product category, alongside recent import price trends. These figures illustrate the cost pressures affecting plumbing professionals and suppliers across the U.S.

| Country | Tariff Rate (2025) | Product Categories Affected | Avg. Import Price Increase (2024–2025) |

|---|---|---|---|

| Vietnam | 46% | Water heaters, pumps, valves | +32% |

| China | 34% | Copper fittings, thermostatic valves, tankless heaters | +28% |

| Taiwan | 32% | Pump parts, brass valves, sensor modules | +24% |

| Japan | 24% | Digital controllers, thermostats, smart mixers | +19% |

| Mexico | 0% | Steel brackets, general plumbing hardware | +11% |

| India | 0% | PVC valves, cast iron pipe, threaded fittings | +14% |

Timeline of Implementation and Policy Background

The current tariff wave started gaining traction in late 2024, but enforcement hit in early 2025. Designed to encourage domestic manufacturing, the policy quickly hit the plumbing and HVAC supply chains. Tariffs increased in two rounds, with the second round adding more component categories. Federal lawmakers cited economic nationalism and supply chain independence as key motivations. However, the policy has added unpredictability for U.S. businesses.

The Global Plumbing Supply Chain – Who Makes What, and Where?

Heavy Reliance on Chinese and Southeast Asian Manufacturers

Most plumbing parts used in repiping services or system upgrades originate in Asian factories. These facilities supply everything from basic PVC elbows to high-end mixing valves. China dominates the market, but Vietnam, Taiwan, and South Korea also play major roles. Many of these parts reach U.S. soil already pre-assembled or partially finished. That means tariffs disrupt both raw material access and final assembly here at home.

U.S. Import Patterns for Plumbing Components

The U.S. imports billions of dollars in plumbing and HVAC components annually. In 2024, imports from China alone made up over 45% of total plumbing-related goods. Vietnam and Taiwan together contributed another 25%. Copper piping, brass valves, electric pumps, and control modules top the list. With tariffs now in place, many of these imports face double-digit cost hikes. That has triggered immediate changes across our supply chain.

The Real Cost Impact: Price Hikes Across Plumbing Materials

Commodity Pressures: Copper, PVC, Steel

Copper prices have surged 38% in just the past year. This matters because nearly every plumbing project uses copper in some form. PVC and CPVC prices have also risen, driven by supply shocks and demand. Steel, used in brackets, hangers, and fittings, now costs 21% more. These rising input costs affect every project’s bottom line. Tariffs only add fuel to the inflation fire.

Finished Goods: Water Heaters, Pumps, Valves

Homeowners now pay up to 30% more for water heaters than they did last year. Pumps, especially booster and sump models, cost 18% more across most major brands. Valves and control units also reflect sharp cost jumps, some as high as 25%. These increases reflect both raw material tariffs and higher overseas manufacturing costs. We’re seeing sticker shock at every level of the customer chain.

Margin Compression for Contractors and Distributors

Small contractors and independent wholesalers have taken the hardest hit. With prices rising but budgets fixed, margins are getting squeezed. Some businesses are absorbing the cost, while others must pass it on. Even quoting a job has become more difficult due to weekly price fluctuations. Even routine jobs like drain cleaning now face pricing volatility due to rising costs of fittings and chemicals.

U.S. Manufacturers Under Pressure

Assembly vs. Full Production: The Hidden Dependency

While some companies advertise “Made in the USA,” many still rely on tariffed components. Motors, circuit boards, and plastic housings often come from Asia. U.S. factories assemble them, but that doesn’t shield them from cost spikes. True reshoring would require massive investment in tooling, training, and raw material sourcing. A 2024 study even proposes a Reshorability Index (RI) to evaluate feasibility, underscoring the economic and environmental complexity of bringing production back home.

Price Pass-Through or Absorption?

U.S. manufacturers now face a tough choice: raise prices or eat the cost. Brands like Rheem, AO Smith, and Zoeller have issued public notices of price increases. Others try to maintain customer trust by absorbing partial increases. However, that strategy erodes profits and reduces reinvestment capacity. Everyone in the chain must choose between growth and survival in a volatile landscape.

Market Response: Adaptations, Delays, and Sourcing Shifts

Alternative Sourcing from Non-Tariffed Countries

Some distributors have started shifting sourcing to Mexico, India, and Eastern Europe. While these regions offer cost advantages, the transition is slow and not always smooth. Language barriers, inconsistent quality, and longer shipping times create new challenges. Some U.S. suppliers now test multiple vendors to avoid sole-source dependence. This move diversifies risk but demands more oversight.

Construction Project Delays and Requotes

Delays have become common in both residential and commercial builds. Plumbers can’t start jobs without guaranteed material costs. Developers request multiple re-quotes as supply prices shift weekly. Smaller projects often proceed, but larger builds now move cautiously. For example, we’ve postponed three school installations this spring due to price uncertainty. According to a 2025 trade network analysis, such delays reflect broader disruptions across the entire import chain caused by tariff blockages.

Regulatory and Inflationary Ripple Effects

Impact on National Inflation and the Housing Market

The Congressional Budget Office expects these tariffs to raise inflation by 0.4 percentage points in both 2025 and 2026. That affects not just plumbing, but every aspect of home construction. Rising material costs push new home prices higher, which slows down housing starts. This compounds affordability challenges already felt across much of Florida. A Brookings report even suggests that retaliatory tariffs have undermined business formation, offsetting the intended benefits of protectionist policy.

Compliance Costs and Policy Uncertainty

Importers now deal with more paperwork, port inspections, and classification changes. These red tape hurdles cost time and money. Add to that the uncertainty of future trade policy shifts, and business planning becomes chaotic. Many manufacturers have delayed expansions or hiring due to this instability. Policy turbulence now holds back long-term growth in our sector.

FAQ – Key Questions About the 2025 Tariff Impact

How much have plumbing material prices increased since the tariffs?

Plumbing material prices have jumped anywhere from 15% to 35% depending on the category. Copper, steel, and PVC have all seen notable hikes. Finished goods like pumps and heaters now cost 20% more on average. These increases reflect both the tariffs and strained global logistics.

Are there any exemptions or workarounds for U.S. plumbing suppliers?

Some niche components qualify for temporary exclusions if no domestic alternatives exist. However, most mainstream products do not qualify. Some suppliers attempt to reclassify goods under non-tariff codes, but this adds legal and compliance risks. Real relief depends on future policy changes or renegotiated trade terms.

Which brands or products are now hardest to source?

Products requiring integrated electronics or specialty metals face the longest delays. Booster pumps, smart thermostatic valves, and tankless heaters are especially hit. Brands heavily reliant on Asian manufacturing face deeper inventory gaps. The shortage is most visible in high-demand commercial plumbing solutions.

How long are these tariffs expected to stay in place?

Right now, the 2025 tariffs have no fixed end date. Policymakers suggest they may remain until domestic production capacity improves. Trade talks may ease some pressures, but there’s no timeline for rollback. Businesses should plan for long-term impact, not short-term relief.

Industry Reactions and Advocacy Efforts

What Trade Associations Are Saying

The Plumbing-Heating-Cooling Contractors Association (PHCC) has expressed deep concern over the long-term consequences. NAHB and ACCA have joined forces to lobby for exemptions and policy transparency. These groups argue that tariffs stifle growth and penalize small businesses. Public statements emphasize the need for a phased approach, not sweeping blocks. Advocacy continues, but results remain uncertain.

How Retailers and OEMs Are Communicating With End Users

Many brands now issue monthly bulletins to update customers on price changes and availability. Retailers emphasize transparency and encourage early ordering to lock in pricing. OEMs like Delta and Moen highlight production adjustments on their websites. At North Fort Myers Plumbing, we explain these changes directly to our clients in simple terms. Honest communication builds trust during uncertain times.

3 Practical Tips – Navigating the Tariff Turbulence

- Reassess sourcing and bid timelines early in the project lifecycle: Don’t assume past pricing still applies—update quotes monthly. Include escalation clauses in your contracts.

- Leverage group purchasing organizations (GPOs) to offset pricing volatility: Join trade groups that pool orders for better pricing and faster fulfillment.

- Communicate early and often with suppliers about inventory cycles: Stay in sync with your reps and set reorder points before backorders hit. Planning ahead saves headaches.

Looking Ahead – What Comes Next for the U.S. Plumbing Industry?

If current trends continue, the plumbing industry may see a reshoring movement over the next decade. However, that shift requires major investment in workforce development and manufacturing capacity. More likely, we’ll see a hybrid system with some parts made here and others sourced abroad. Automation and material science may also offer cost-cutting breakthroughs. Until then, contractors and suppliers must stay nimble, informed, and proactive.

From my vantage point as a Florida plumber, this isn’t just a pricing issue. It’s a business survival issue. Our community must adapt together to navigate this tariff storm.

- Addressing Low Water Pressure in Older Florida Homes: Diagnosis, Solutions, and When to Call a Plumber - December 11, 2025

- Chloramine in Lee County Water: Understanding Its Impact on Rubber Gaskets, Water Heater Elements, and Plumbing Lifespan. - December 4, 2025

- Plumbing Durability for SWFL Rental Properties: Choosing Fixtures and Systems That Withstand High-Occupancy Wear and Tear - November 25, 2025